News & Insights

Comprehensive Approach to Tax Planning for U.S. Multinational Corporations

As multinational corporations continue to expand their operations globally, they must navigate a complex web of tax regulations and laws. It is essential that they

The Importance of Not Overblocking for UBIT

Taxes play an important role in the structure of a fund. There are various categories of investors that have different tax implications which will impact

IRS Delays Implementation of $600 Threshold for Third-Party Payment platforms’ Forms 1099-K

For calendar years beginning after December 31, 2022, the third-party payment organizations are required to report payments in settlement of third-party network transactions with any

Klug Counsel PLLC in 2022

We hope you and your family are healthy, safe, and enjoying the holiday season to end 2022. We would like to take this opportunity to

Estate and Gift Tax Exemption Amount to Significantly Increase with Inflation

Every year, the estate and gift tax “basic exclusion amount” (commonly known as the “estate and gift tax exemption amount”) is adjusted for inflation. The

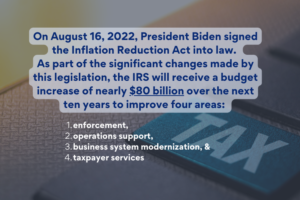

IRS will Prioritize Enforcement Under $80B Funding: Large Business and International Division

On August 16, 2022, President Biden signed the Inflation Reduction Act into law. As part of the significant changes made by this legislation, the IRS

IRC §754 Election: Partner Signature No Longer Required for Partnership Basis Election

Treasury and the Internal Revenue Service (“IRS”) have finalized regulations that eliminate the requirement that an Internal Revenue Code (“IRC”) 754 election statement to adjust

Crypto Brokers and Exchanges Informational Reporting Likely Delayed

The Treasury Department (“Treasury”) and the Internal Revenue Service (“IRS”) are likely to delay a January date for crypto brokers and exchanges to begin tracking

Deducting Cryptocurrency Losses

Many investors in cryptocurrencies have seen their investments lose significant value in recent months. U.S. taxpayers who have losses from their digital asset investments or